Bruce Brammall, 3 October, 2018, Eureka Report SUMMARY: ATO cuts some new DIY fund members off at the knees, while those with multiple SMSFs given a fair warning. The Taxman occasionally likes to remind us that he’s no dummy. He knows what’s goin’ on, in the Big Brother sense. In these times of Big […]

Bruce Brammall, 26 September, 2018, Eureka Report SUMMARY: AMP exits the SMSF lending market, increasing risks for LRBA borrowers. Some signs are beginning to look a bit ominous for DIY super property investors. Another major lender left the playing field yesterday (Tuesday), reducing a significant option for trustees looking to use self-managed super […]

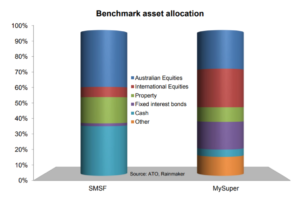

Bruce Brammall, 19 September, 2018, Eureka Report SUMMARY: SMSFs pull ahead on performance, as trustees adjust to rule changes to play the game smarter, with better advice. Active investment and contribution decisions by DIY trustees in recent years are leading to outperformance and better tax outcomes. Self-managed superannuation funds have embraced the new deductible super […]

Bruce Brammall, 12 September, 2018, Eureka Report SUMMARY: Concessional contribution limit reductions have made the call on insurance inside super a tougher decision. Here’s what you need to consider. Life insurance is a beast that has been smashed from pillar to post in recent times. Commissions have been demonised and reformed, with more reform […]

Bruce Brammall, 5 September, 2018, Eureka Report SUMMARY: Time to start considering the impact of a Labor victory at the next election on your investment portfolio. The dust is settling on the brutal shenanigans in Canberra of the last fortnight. And the likely impact on your super is becoming clearer. The change in prime […]

Bruce Brammall, 29 August, 2018, Eureka Report SUMMARY: Are you considering selling property to get money into super? Here’s what you need to consider. It is rare that no-one has any regret about a life of successful investing. In hindsight, there will always have been missed opportunities, or the one that got away. There […]

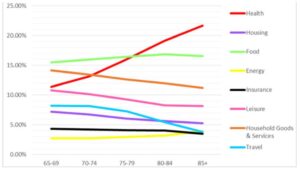

Bruce Brammall, 15 August, 2018, Eureka Report SUMMARY: Will we spend money like drunken sailors in retirement? Surprisingly, not as many of us as we’d think. There’s not much about retirement figures nowadays that could truly surprise me. Most numbers are just progressions, updates of what we’ve seen before. Up a bit. Down a bit. […]

Bruce Brammall, 8 August, 2018, Eureka Report SUMMARY: Running multiple pensions and drawdowns can deliver a better taxable result for beneficiaries after you’ve checked out. Superannuation, as we know, is a tax play. In return for restricted access to our retirement savings, the government taxes super “lightly”. It’s not only while we’re alive and […]

Bruce Brammall, 1 August, 2018, Eureka Report SUMMARY: Should you turn on a super pension? Not the simple question it used to be. You’ve hit round about that age and your super is sort of hanging out there like a ripe fruit ready to pluck off the tree. But just because it’s there, do […]

Bruce Brammall, 25 July, 2018, Eureka Report SUMMARY: A positive year all all asset classes. How did you perform as SMSF investment manager? Did you beat 8.25%? Nothing blew anything out of the park, but it was a solid year across investment markets. You should have every reason to smile. Unlike last year, when fixed […]

© Bruce Brammall Financial 2009 -2025

Bruce Brammall Financial Pty Ltd as trustee for the Castellan Financial Consulting Unit Trust is an authorised representative of Sentry Advice Pty Ltd (AFSL number 227748). Bruce Brammall Financial Pty Ltd as trustee for the Castellan Financial Consulting Unit Trust is not authorised to provide credit services. All credit and mortgage services referred to on this website are provided by Bruce Brammall Lending Pty Ltd (ACL number 448881). The information contained within the website is of a general nature only. Whilst every care has been taken to ensure the accuracy of the material, Bruce Brammall Financial will not bear responsibility or liability for any action taken by any person, persons or organisation on the purported basis of information contained herein. Without limiting the generality of the foregoing, no person, persons or organisation should invest monies or take action on reliance of the material contained herein but instead should satisfy themselves independently of the appropriateness of such action.