Bruce Brammall, 17 January, 2018, Eureka Report SUMMARY: Smaller DIY funds are less satisfied with returns than industry funds for the first time. Why? It seems that many of us super trustees are getting a little down on ourselves. A survey of all super fund members has found that those with smaller self-managed super funds […]

Bruce Brammall, 13 December, 2017, Eureka Report SUMMARY: A win for older Australians, but probably at the expense of first-home buyers. You hardly call it an all-out war on property prices. In reality, it’s impact is barely likely to be felt. Like an earthquake measuring “2” on the Richter scale – not commonly felt […]

Bruce Brammall, 29 November 2017, Eureka Report SUMMARY: Property investors have two new super tools available to cut their capital gains. Here’s how to plan to save CGT. Property investors don’t get a lot of sympathy in general. And, okay, it’s a bit understandable. In recent decades, property investors have made squillions, as property markets […]

Bruce Brammall, 25 October 2017, Eureka Report SUMMARY: SMSF expenses have nearly tripled in just five years! Have you lost control of your super fund costs? Trustees of self-managed super funds appear to have lost control of their expenses – average expenses per fund have nearly tripled in five years. The cost blowout […]

Bruce Brammall, 18 October 2017, Eureka Report SUMMARY: A limit of $1.6m in super? No! You are unlimited as to how big you can grow your super fund. There is an absurd misunderstanding gaining traction around the country about superannuation. It’s a message that the government hasn’t been deliberately pushing. However, it certainly won’t […]

Bruce Brammall, 11 October 2017, Eureka Report SUMMARY: Interest-only or principal and interest for your SMSF loan? This decision for SMSFs has become collateral damage, so here’s what to consider. There was a time when interest-only loans were close to being the only way to go for investment property, including inside super. Interest-only repayments […]

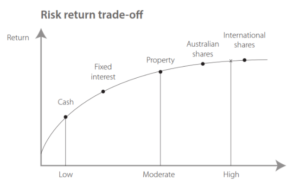

Bruce Brammall, 4 October 2017, Eureka Report SUMMARY: Asset allocation has become a whole-of-wealth game since 1 July. Have you put enough thought into it? The new rules for super checked in three months ago, on 1 July. So, have you changed anything about your thinking since then? For most, the answer […]

SUMMARY: Insurance is an important consideration in super, despite industry arguments. Here’s what you need to consider. Life insurance is fighting a rising tide of discontent, predominantly caused by too many scandals. Insurance in super, even more so, is on the nose. Industry-led attempts to “fix” the current opt-out rules have not been well […]

Here’s an unlikely financial advice question: “Where does your favourite pizza come from?” When we last moved house, we moved out of delivery range of my favourite pizza delivery place. Devastated. So, the search started. Every time pizza was being hankered for, we tried a different place. Nothing came close. All options were second […]

In any job, industry or profession, if you’re around long enough, you get to know the lies that are told during a transaction. For example … teachers and students, particularly regarding homework (which includes my little DebtBoy, bless him, who has been caught out, thanks to parent/teacher conferences). Defence lawyers and their clients, journalists […]

© Bruce Brammall Financial 2009 -2025

Bruce Brammall Financial Pty Ltd as trustee for the Castellan Financial Consulting Unit Trust is an authorised representative of Sentry Advice Pty Ltd (AFSL number 227748). Bruce Brammall Financial Pty Ltd as trustee for the Castellan Financial Consulting Unit Trust is not authorised to provide credit services. All credit and mortgage services referred to on this website are provided by Bruce Brammall Lending Pty Ltd (ACL number 448881). The information contained within the website is of a general nature only. Whilst every care has been taken to ensure the accuracy of the material, Bruce Brammall Financial will not bear responsibility or liability for any action taken by any person, persons or organisation on the purported basis of information contained herein. Without limiting the generality of the foregoing, no person, persons or organisation should invest monies or take action on reliance of the material contained herein but instead should satisfy themselves independently of the appropriateness of such action.