Bruce Brammall, 7 November, 2018, Eureka Report SUMMARY: What you need to know and do about your super before you die – super estate planning basics. Death is never easy for those left behind. And when it comes to superannuation and death benefits, it’s become a whole lot messier in recent times. The […]

Bruce Brammall, 24 October, 2018, Eureka Report SUMMARY: Australia’s retirement income system scores a B, losing our spot on the podium to Finland. Ballooning household debt and tougher testing for government pensions have seen Australia’s retirement incomes system marked down in an international survey. Australia gave up the third spot on the podium this year […]

Bruce Brammall, 17 October, 2018, Eureka Report SUMMARY: Three reasons that should, and three reasons that should not, be why you might set up a SMSF. It might seem like a self-managed super fund is the trend. And if everyone else seems to be doing it, surely you can do it to. Not so fast. […]

Bruce Brammall, 10 October, 2018, Eureka Report SUMMARY: Is the Aussiegolfa decision a small crack in the dam for SMSFs wanting to lease residential properties to related parties? DIY funds have always operated under a simple rule when it comes to residential property – never, ever, lease it to a related party. Just steer clear, […]

Bruce Brammall, 3 October, 2018, Eureka Report SUMMARY: ATO cuts some new DIY fund members off at the knees, while those with multiple SMSFs given a fair warning. The Taxman occasionally likes to remind us that he’s no dummy. He knows what’s goin’ on, in the Big Brother sense. In these times of Big […]

Bruce Brammall, 26 September, 2018, Eureka Report SUMMARY: AMP exits the SMSF lending market, increasing risks for LRBA borrowers. Some signs are beginning to look a bit ominous for DIY super property investors. Another major lender left the playing field yesterday (Tuesday), reducing a significant option for trustees looking to use self-managed super […]

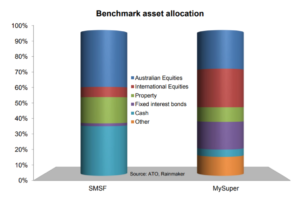

Bruce Brammall, 19 September, 2018, Eureka Report SUMMARY: SMSFs pull ahead on performance, as trustees adjust to rule changes to play the game smarter, with better advice. Active investment and contribution decisions by DIY trustees in recent years are leading to outperformance and better tax outcomes. Self-managed superannuation funds have embraced the new deductible super […]

Bruce Brammall, 12 September, 2018, Eureka Report SUMMARY: Concessional contribution limit reductions have made the call on insurance inside super a tougher decision. Here’s what you need to consider. Life insurance is a beast that has been smashed from pillar to post in recent times. Commissions have been demonised and reformed, with more reform […]

Bruce Brammall, 5 September, 2018, Eureka Report SUMMARY: Time to start considering the impact of a Labor victory at the next election on your investment portfolio. The dust is settling on the brutal shenanigans in Canberra of the last fortnight. And the likely impact on your super is becoming clearer. The change in prime […]

Bruce Brammall, 29 August, 2018, Eureka Report SUMMARY: Are you considering selling property to get money into super? Here’s what you need to consider. It is rare that no-one has any regret about a life of successful investing. In hindsight, there will always have been missed opportunities, or the one that got away. There […]

© Bruce Brammall Financial 2009 -2025

Bruce Brammall Financial Pty Ltd as trustee for the Castellan Financial Consulting Unit Trust is an authorised representative of Sentry Advice Pty Ltd (AFSL number 227748). Bruce Brammall Financial Pty Ltd as trustee for the Castellan Financial Consulting Unit Trust is not authorised to provide credit services. All credit and mortgage services referred to on this website are provided by Bruce Brammall Lending Pty Ltd (ACL number 448881). The information contained within the website is of a general nature only. Whilst every care has been taken to ensure the accuracy of the material, Bruce Brammall Financial will not bear responsibility or liability for any action taken by any person, persons or organisation on the purported basis of information contained herein. Without limiting the generality of the foregoing, no person, persons or organisation should invest monies or take action on reliance of the material contained herein but instead should satisfy themselves independently of the appropriateness of such action.