Bruce Brammall, 13 November, 2019, Eureka Report SUMMARY: Super fund property gearing is still an effective, legitimate, strategy. With property markets rebounding, could it deliver rewards for you? In recent times, “super fund property gearing” has become a dirty phrase. For two years, until recently, property prices in the two biggest markets of Sydney […]

Bruce Brammall, 16 October, 2019, Eureka Report SUMMARY: In-specie transfers to your SMSF should be back on the table, particularly for employees. The world’s entered a time-warp dimension when just the franking credits on a parcel of shares in a super fund are giving better returns than cash. Buy some Westpac shares and you’ll get […]

Bruce Brammall, 18 September, 2019, Eureka Report SUMMARY: Partners in life and partners in super, Part II. Two more strategies for better super balances and bigger government pensions. Sometimes by giving a little ground in a relationship, you can both come out bigger overall winners. That doesn’t seem to be working too well for […]

Bruce Brammall, 4 September, 2019, Eureka Report SUMMARY: Funds flow to industry funds, in wake of Royal Commission making “choice” funds a tough case. Self-managed and retail superannuation funds have suffered big swings against them in the latest industry statistics. The two sectors at the “choice” end of the super spectrum posted anaemic growth rates […]

Bruce Brammall, 21 August, 2019, Eureka Report SUMMARY: Partners in life and partners in super – two strategies to maximise tax-free super in your marriage. Superannuation is often seen as an individual sport – one person fighting to create the biggest pot they can. But played right, for couples, super should be a team sport. […]

Bruce Brammall, 7 August, 2019, Eureka Report SUMMARY: Restrictions on contributions for SMSFs with LRBAs are about to increase. What you need to know now for fresh borrowings. DIY super investors might be forced to sell other fund assets to repay property loans, under new laws designed to further restrict contributions. The Morrison […]

Bruce Brammall, 24 July, 2019, Eureka Report SUMMARY: Being the “right kind” of defensive paid well for super fund investors last year. Did your SMSF top a return of 9.16%? It’s not often that defensive investors will be as well rewarded as they were last financial year. It’s […]

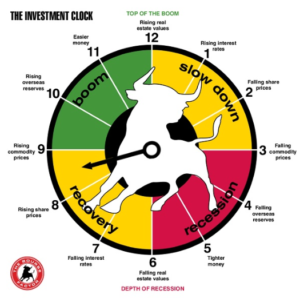

Bruce Brammall, 10 July, 2019, Eureka Report SUMMARY: Cash is dead. But where do you go if you’re looking to take extra risk? And how much do you risk do you really want to take? Whoa, cash is definitely dead. Even if it had a pulse in recent years, which is doubtful, it’s definitely […]

Bruce Brammall, 12 June, 2019, Eureka Report SUMMARY: Time to do an urgent stocktake of your personal risk insurance – particularly whatever you’re holding in super. Billions of dollars of insurance was automatically cancelled at the end of the financial year. Bizarre, but true. The government-imposed mass extermination of insurance policies hit on 1 July. […]

Bruce Brammall, 15 May, 2019, Eureka Report SUMMARY: Double “gotcha!” moment on the campaign trail! Sadly, proving neither leader understood their own superannuation policies. One of the great problems with superannuation’s complexity is that the chief idiots-in-charge don’t actually understand what it is they’re making rules about. Superannuation has tripped up many on the campaign trail […]

© Bruce Brammall Financial 2009 -2025

Bruce Brammall Financial Pty Ltd as trustee for the Castellan Financial Consulting Unit Trust is an authorised representative of Sentry Advice Pty Ltd (AFSL number 227748). Bruce Brammall Financial Pty Ltd as trustee for the Castellan Financial Consulting Unit Trust is not authorised to provide credit services. All credit and mortgage services referred to on this website are provided by Bruce Brammall Lending Pty Ltd (ACL number 448881). The information contained within the website is of a general nature only. Whilst every care has been taken to ensure the accuracy of the material, Bruce Brammall Financial will not bear responsibility or liability for any action taken by any person, persons or organisation on the purported basis of information contained herein. Without limiting the generality of the foregoing, no person, persons or organisation should invest monies or take action on reliance of the material contained herein but instead should satisfy themselves independently of the appropriateness of such action.