Bruce Brammall, 10 July, 2019, Eureka Report

SUMMARY: Cash is dead. But where do you go if you’re looking to take extra risk? And how much do you risk do you really want to take?

Whoa, cash is definitely dead. Even if it had a pulse in recent years, which is doubtful, it’s definitely flatlining now.

With two interest rate cuts in consecutive months, from what was already ridiculously low, the only reason for self-managed super funds having money in a bank account now is safety.

You’re not earning anything. But your money, in a bank account, ain’t going to disappear. The government guarantees deposits up to $250,000 … per institution.

If you work hard enough, and are prepared to actively manage your cash holdings, you can get more than 2%, maybe even 2.5%, on the folding stuff.

But with inflation running at 1.3%, and tax to pay on interest for funds in accumulation mode, your money isn’t moving forward.

SMSFs had $171 billion of cash sitting in their funds as at March 2019, out of a total of $747 billion in assets.

That’s nearly 23% of fund assets in cash. Earning three-eighths of four-fifths of virtually nothing.

Yes, all SMSFs need cash. There are invoices to pay. And short-term opportunities to take, which occasionally require cash. But if you’re not looking at your super fund at the moment and thinking about whether you’re holding too much of it, then you’re not doing your job as a trustee.

Are you holding more than the average? Should you be? Does your current position really meet your appetite for risk?

Your willingness, as trustee and member, to take a risk with your investments is ultimately what’s at stake here.

Interest rate movements tend to have flow-on effects to other investment markets. In general, rates falling will lead to fixed interest-rate investments increasing, as the value of the steady income payments becomes greater.

They generally also lead to increases in share and property prices, as investors move money from cash, chasing higher returns from other, riskier, asset classes.

As SMSF trustees, it’s important for you, now, to take a good look at the assets in your fund. These interest rate cuts – with potentially more to follow – is, arguably, a more important event than the shock election victory of the Morrison Government, to take advantage of situational economics.

Cash returns are effectively zero. Almost any other asset class is likely to offer a better return in the short to medium term.

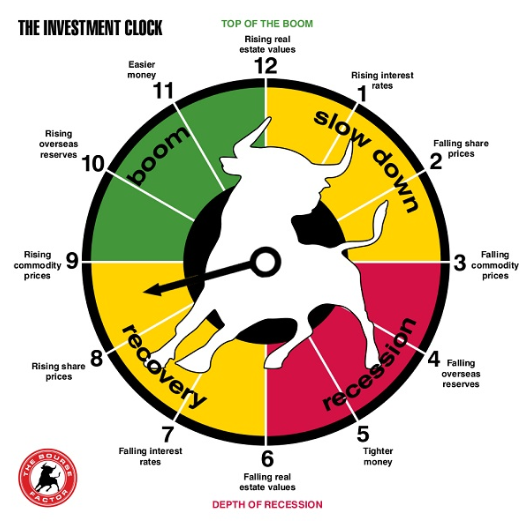

So, let’s run through the asset classes and their base-level risks at this point of the cycle. I’ve included, as Graph 1, a basic “investment clock” below, from the ASX (ignore the positional arrow at 8.30, please). Not every investment cycle follows the investment clock, far from it. For example, Australia hasn’t had a recession since the early 90s. But we have had slowdowns, and we’re sort of currently in one, which is why the Reserve Bank has cut interest rates now. And why the government is pumping money into the economy via tax cuts, which are being handed out now, so that the rest of the clock may continue on its merry path.

Graph 1: The investment clock (ignore the positional arrow)

Cash – why you need it in your SMSF

You can’t get away with zero cash in your super fund. And you shouldn’t try to. You need cash to be able to pay your invoices, insurances and, potentially, to take advantage of investment opportunities when they arise.

But it’s how much extra cash you need on top of that becomes important now.

Cash is the ultimate defensive asset. And being ultimately defensive is what some people might be seeking, given the almost ridiculous returns of the share and property market in the last six months and, perhaps, fearing a snapping of the rubber band.

I remember readers emailing me during the period of, roughly, 2009 to 2012, talking about how they had locked themselves in to five-year term deposits at 7 and 8 per cent in early 2008, just as the markets were first turning feral during the GFC. They got through to early 2013, enjoying total returns of 40-50% during a period when many were wiped out. Locking in to term deposits, at some points in the cycle, can be profitable.

The problem now is that we’re at the other end of the investment cycle. Interest rates are cripplingly low. Yes, investment markets have been reasonable for a period, and indeed in recent years, but as an investment manager, your personal clock starts again … now. Can you take the risk in riskier asset classes?

Cash is one of the two defensive asset classes, the other being fixed interest. If you make the call that you need to have a percentage, whether that’s 20, 40 or 60 per cent in defensives, do you have the right asset mix now?

Fixed interest

Fixed interest, often referred to as “bonds”, have had a stellar year, but have rallied particularly hard in recent months as Australia’s interest rate market has turned.

In general, falling interest rates lead to higher bond prices. The lower yield from cash makes fixed interest-rate paying investments more attractive, so they tend to rise.

Across the market, fixed interest-rate investments finished the year in the high single digits, depending on the level of risk that you were prepared to take, from government through to corporate bonds. It was actually the safer end of this market, government, that performed better during the period.

For those who wish to be more defensive, should you have more money into fixed interest, rather than cash?

Growth assets – property and shares

Interest rate reductions make all other asset classes look more appealing. Particularly property and shares.

The income streams from property are reasonably predictable – although less so than fixed interest. But they obviously look more appealing when compared with falling income from bank deposits.

Dividends from shares are the least predictable of all asset class income returns. Companies tend to only pay dividends from profits. If there aren’t any, they rarely pay them. (However, they still need to meet any fixed interest security commitments.)

Property, as an asset class, is a more volatile asset than cash and shares, obviously, are more volatile again. Who can forget that listed property fell 75% from top to bottom, though over a longer period, than the 55% of the Australian market during the GFC?

But there is a considerable risk/return trade off for property and shares.

Moving up the risk chain

Essentially, is it time to be moving your money up the risk chain?

That’s a question that SMSF trustees should only be trying to evaluate once you’ve had a proper consideration of the “risk profile” of your members (ie, you).

You can find risk profiles all over the internet, of varying quality. Surprisingly, it’s not something you inately know – I’ve met dozens of people who think they are conservative, when they’re not. And plenty who thought they were risk takers, who weren’t.

There are many who believe that your risk tolerance never changes, but I disagree. I think it does change over time. (In my opinion, it can change depending on how you wake up in the morning. However, this is rare. Most people’s risk profile will only move slightly, over the short to mediium term.)

Understand your ability to take a risk is what’s important here.

Importantly, if you have been underinvested, from a cash/fixed interest versus property/shares perspective, then now is probably the time to review that. And the timing has probably never been better to make some changes.

*****

The information contained in this column should be treated as general advice only. It has not taken anyone’s specific circumstances into account. If you are considering a strategy such as those mentioned here, you are strongly advised to consult your adviser/s, as some of the strategies used in these columns are extremely complex and require high-level technical compliance.

Bruce Brammall is managing director of Bruce Brammall Financial and is both a licensed financial adviser and mortgage broker. E: bruce@brucebrammallfinancial.com.au .