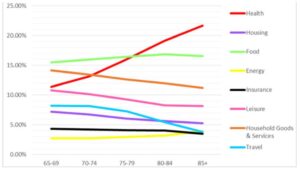

Bruce Brammall, 15 August, 2018, Eureka Report SUMMARY: Will we spend money like drunken sailors in retirement? Surprisingly, not as many of us as we’d think. There’s not much about retirement figures nowadays that could truly surprise me. Most numbers are just progressions, updates of what we’ve seen before. Up a bit. Down a bit. […]

Bruce Brammall, 8 August, 2018, Eureka Report SUMMARY: Running multiple pensions and drawdowns can deliver a better taxable result for beneficiaries after you’ve checked out. Superannuation, as we know, is a tax play. In return for restricted access to our retirement savings, the government taxes super “lightly”. It’s not only while we’re alive and […]

Bruce Brammall, 1 August, 2018, Eureka Report SUMMARY: Should you turn on a super pension? Not the simple question it used to be. You’ve hit round about that age and your super is sort of hanging out there like a ripe fruit ready to pluck off the tree. But just because it’s there, do […]

Bruce Brammall, 22 November 2017, Eureka Report SUMMARY: The new personal deductible contribution rules will be a big boost for your super. But there are some complexities. Bright spots were few and far between in the recent super upheaval – but the new allowances for personal deductible contributions topped the list. Another was the “five-year […]

SUMMARY: Into your super or into your home? Where do you plough excess savings? Something left over after all the bills are paid is generally the aim of the game. It happens too rarely, to too few. The reality is, for most, where excess savings exist, expenditure rises to meet the challenge. But for those […]

SUMMARY: Real-time reporting of pension income streams is coming. Here’s what you need to start thinking about. TBAR sounds like something your kids (or grandkids) might play on, or with, in the school yard. But no. It stands for “transfer balance account report”. And it’s something that anyone with a self-managed […]

SUMMARY: Do you really know the asset allocation of your SMSF? Sit down and figure it out. And be ruthless. The plight of the DIY super trustee is that it can be a lonely occupation. (Yes, despite there being more than a million of us.) Decisions are usually made in isolation. They’re […]

While super’s best brains search for a golden goose of retirement income products, just stay focussed on building your nest egg. We are nearly three years into the search for new ways of delivering better superannuation income streams to retirees. And so far, we’ve had almost nothing. Product innovation is virtually non-existent. People […]

SUMMARY: If your kids still listen to you … here’s what you need to tell them to do with their super. My son is 10. He still listens to his dad. Mostly. He knows his dad is a financial adviser who “helps people with their money”. He understands that includes investing in “stuff”, including […]

SUMMARY: Lending for SMSFs has been turned on its head. Does it still work as a strategy? It’s tighter, but yes. Property investment is a honey pot. It attracts everyone interested in making a dime. And not just from an investment perspective – developers and the lending industry too. Property’s role, from a […]

© Bruce Brammall Financial 2009 -2025

Bruce Brammall Financial Pty Ltd as trustee for the Castellan Financial Consulting Unit Trust is an authorised representative of Sentry Advice Pty Ltd (AFSL number 227748). Bruce Brammall Financial Pty Ltd as trustee for the Castellan Financial Consulting Unit Trust is not authorised to provide credit services. All credit and mortgage services referred to on this website are provided by Bruce Brammall Lending Pty Ltd (ACL number 448881). The information contained within the website is of a general nature only. Whilst every care has been taken to ensure the accuracy of the material, Bruce Brammall Financial will not bear responsibility or liability for any action taken by any person, persons or organisation on the purported basis of information contained herein. Without limiting the generality of the foregoing, no person, persons or organisation should invest monies or take action on reliance of the material contained herein but instead should satisfy themselves independently of the appropriateness of such action.