Bruce Brammall, 15 August, 2018, Eureka Report SUMMARY: Will we spend money like drunken sailors in retirement? Surprisingly, not as many of us as we’d think. There’s not much about retirement figures nowadays that could truly surprise me. Most numbers are just progressions, updates of what we’ve seen before. Up a bit. Down a bit. […]

Bruce Brammall, 8 August, 2018, Eureka Report SUMMARY: Running multiple pensions and drawdowns can deliver a better taxable result for beneficiaries after you’ve checked out. Superannuation, as we know, is a tax play. In return for restricted access to our retirement savings, the government taxes super “lightly”. It’s not only while we’re alive and […]

Bruce Brammall, 1 August, 2018, Eureka Report SUMMARY: Should you turn on a super pension? Not the simple question it used to be. You’ve hit round about that age and your super is sort of hanging out there like a ripe fruit ready to pluck off the tree. But just because it’s there, do […]

Bruce Brammall, 25 July, 2018, Eureka Report SUMMARY: A positive year all all asset classes. How did you perform as SMSF investment manager? Did you beat 8.25%? Nothing blew anything out of the park, but it was a solid year across investment markets. You should have every reason to smile. Unlike last year, when fixed […]

Bruce Brammall, 18 July, 2018, Eureka Report SUMMARY: Property and gearing are on the nose, but it doesn’t mean good property isn’t the right solution for savvy investors. When it comes to superannuation, we’re all aware now that when the tide turns, it can happen quickly. Government decisions to reduce contribution limits are […]

Bruce Brammall, 20 June, 2018, Eureka Report SUMMARY: Grand final time for superannuation contributions. Are you ready? The traditional cold sweats/mad panics of the back-end of June have passed by now. For so many, in so many aspects of your financial life – business, personal and SMSF – you should have been looking for those last-minute […]

Bruce Brammall, 13 June, 2018, Eureka Report SUMMARY: Is $1 million the new “viability threshold” for a SMSF? I’m going to start with what I hope is an unarguable fact: Many SMSFs should never have been set up in the first place. I don’t know for certain what the actual percentage would be. I would […]

Bruce Brammall, 23 May, 2018, Eureka Report SUMMARY: Could the government force business owners to pay themselves super? Not likely. But it’s more than a thought bubble. Running your own business can be a tough gig, particularly in the early years when building reliable cashflow. Administration, management, red tape and constant cost pressures […]

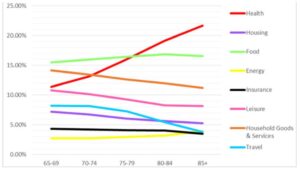

Bruce Brammall, 6 June, 2018, Eureka Report SUMMARY: Spending needs in retirement might not be as high as first thought. But that doesn’t mean YOU shouldn’t aim high. I hope my parents manage to blow their last $100 on their death beds a few minutes before the last of them falls off […]

Bruce Brammall, 30 May, 2018, Eureka Report SUMMARY: Productivity Commission turns up heat on super, but finds little to complain about with SMSF sector. Further structural overhauling of superannuation looks certain after the Productivity Commission’s highly critical report on the industry’s efficiency. Some radical suggestions include only allowing one default fund per member for […]

© Bruce Brammall Financial 2009 -2025

Bruce Brammall Financial Pty Ltd as trustee for the Castellan Financial Consulting Unit Trust is an authorised representative of Sentry Advice Pty Ltd (AFSL number 227748). Bruce Brammall Financial Pty Ltd as trustee for the Castellan Financial Consulting Unit Trust is not authorised to provide credit services. All credit and mortgage services referred to on this website are provided by Bruce Brammall Lending Pty Ltd (ACL number 448881). The information contained within the website is of a general nature only. Whilst every care has been taken to ensure the accuracy of the material, Bruce Brammall Financial will not bear responsibility or liability for any action taken by any person, persons or organisation on the purported basis of information contained herein. Without limiting the generality of the foregoing, no person, persons or organisation should invest monies or take action on reliance of the material contained herein but instead should satisfy themselves independently of the appropriateness of such action.