Bruce Brammall, 17 January, 2018, Eureka Report

SUMMARY: Smaller DIY funds are less satisfied with returns than industry funds for the first time. Why?

It seems that many of us super trustees are getting a little down on ourselves.

A survey of all super fund members has found that those with smaller self-managed super funds are less happy with the investment outcomes than we usually are.

A Roy Morgan survey has found satisfaction for those with SMSF balances of less than $700,000 is now lower than for those who have industry funds.

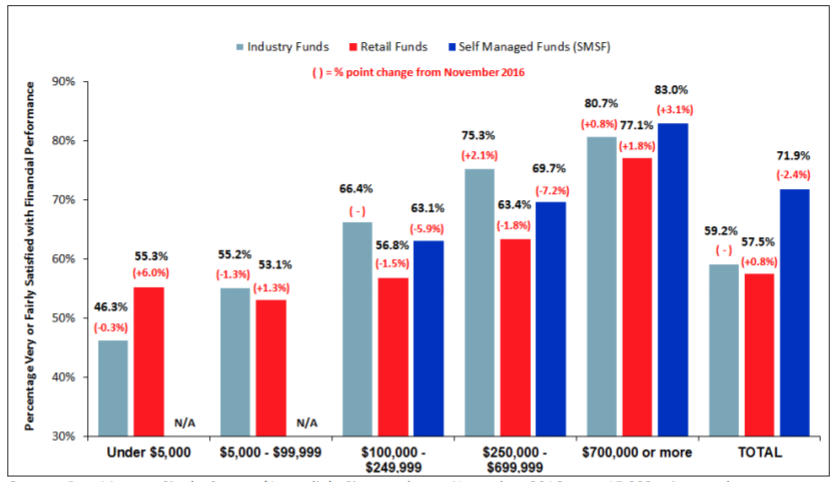

For those with super balances between $100,000 and $250,000, industry fund satisfaction is running at 66.4%, while SMSFs are at 63.1%.

Between $250,00 and $700,000, it is 75.3% versus 69.7%.

In both categories, the fall in satisfaction for SMSFs has been considerable, with a 5.9 percentage point fall in the $100-250k category and a 7.2% fall among the $250-700k space.

Table 1: Not satisfied – smaller SMSFs unhappy with performance

Source: Roy Morgan Single Source (Australia), for the six months to November 2017.

Once the super fund balance tips over $700,000, according to Roy Morgan, SMSFs are comfortable leaders in their happiness with the performance of their funds, with 83% of SMSFs being satisfied, versus 80.7% for industry funds and 77.1% for retail funds.

And overall, for all balances, SMSFs come out on top, strongly. Overall satisfaction with SMSFs sits at 71.9%, while industry funds are at 59.2% and retail at 57.5%. However, the figures for retail and industry are dragged down by the quantum and dis-satisfaction of those with balances of less than $100,000, where SMSFs aren’t counted in the survey.

(Interestingly, this is the first time in seven months that industry funds have had a lead over retail funds.)

The survey isn’t a once off. Roy Morgan says it surveys 30,000 people a year on the topic. It has done so for a long time. And these figures are a compilation of the six months to November 2017. So, it suggests the slide comes from a period going throughout most of the middle of last year.

So, what has caused the slump in satisfaction with investment performance for smaller SMSFs?

The survey doesn’t go into the reasons. And we know, as SMSF trustees, that we technically only have ourselves, as the fund’s investment managers, to blame.

Further, we only have ourselves to blame as individuals, because we’re only managing our own money and making individual investment choices for ourselves, in our own time frames.

So, if we’ve become unhappy with our own performances as investment managers, why?

In the absence of hard data, I’m going to just have to have some educated guesses.

The barbells are ringing

My top tip would be the “barbell” nature of so many SMSF investors. And what it has meant for investment returns.

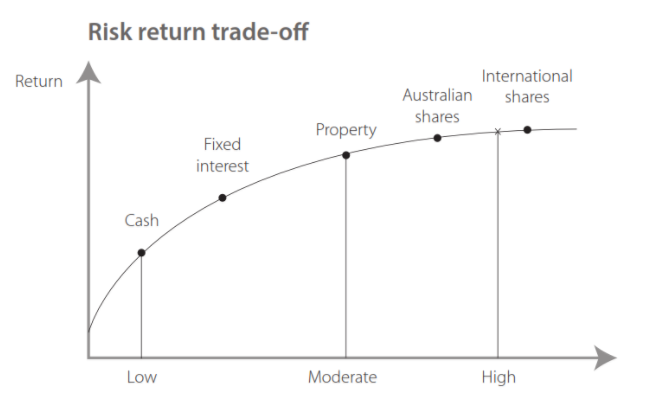

What I mean by barbell is so many, particularly smaller, SMSFs are massively overweight in Australian cash and Australian shares. Cash and shares are at opposite ends of the risk/return spectrum.

Graph 1: Risk return trade-off of asset classes

Cash returns have been long dead. It seems like it was a generation ago that you could get a reasonable return on what you held on deposit.

But so many SMSFs continue to hold on to cash. And I think there are three reasons that this might be impacting on satisfaction.

You invest in cash for a number of reasons. It is partly about safety. It is partly about liquidity for opportunities. And it is partly about fear-based inertia – you’ve been wanting to get into other assets for some time, but fear there are bubbles in markets, which stops you from taking the plunge.

The problem here is that, yes, some great returns have been missed. But if you continue sitting on the sidelines in cash, are you going to miss further real gains from other asset classes?

Lack of diversification

The real problem with barbells is the lack of diversification. So many SMSFs are missing out on the returns offered by other asset classes, such as fixed interest, property and international shares.

For the last seven or so years, I have written an annual column for Eureka Report in July, showing you what your performance would have been if you had left the management of your super fund to an index manager. The point of the annual article is to show off the benefits of diversification. (For the last one, see 19/7/17.)

For most of the last seven years, international shares have outperformed Australian shares. And fixed interest has outperformed cash. And in the last few years in particular, real estate investment trusts have been stellar. (That doesn’t mean any of these returns will continue, of course.)

In essence, if the typical SMSF had moved a portion of their cash to fixed interest and a portion of their Australian shares to international shares (and property), their performance would have been considerably improved.

The chase for yield … has run its race

For years, the “chase for yield” was the thing. If you joined that race, but didn’t notice that the race ended some time ago, you’re a relative loser.

The strategy helped float the boats of anyone offering higher relative yields. And it provided significant returns for a number of years.

But that’s long gone, according to the stats. Let’s take Vanguard, which runs both a pure index ASX 200 fund and one that focuses on high-yield in that sector. For calendar 2017, the index fund grossed 12%, while high-yield achieved 10.19%. Over three years, it was 8.76% versus 5.57%. For longer time periods, the high-yield fund is winning.

If you made the adjustment to chase yield when the race was on, you probably did well. If you didn’t actively change that strategy some years ago, it’s continuing to hurt.

What to do?

Your role as an SMSF trustee is ongoing. It’s not a full-time job, but it’s a constant responsibility. And finding the time to stay educated and make the big decisions can, sometimes, be difficult.

But you need to do it. And there are some simple ways of doing so.

One, consider using a tool like Investsmart’s HealthCheck to get a better understanding of how well diversified your portfolio is.

Two, sit down with a knowledgeable financial adviser. They will be able to walk you through the risks in your current portfolio and what changes could be made to take away some of those risks. Pay them for their time – it will probably be an eye-opener for you and could be the best couple of hours you spend this year.

*****

The information contained in this column should be treated as general advice only. It has not taken anyone’s specific circumstances into account. If you are considering a strategy such as those mentioned here, you are strongly advised to consult your adviser/s, as some of the strategies used in these columns are extremely complex and require high-level technical compliance.

Bruce Brammall is managing director of Bruce Brammall Financial and is both a licensed financial adviser and mortgage broker. E: bruce@brucebrammallfinancial.com.au . Bruce’s book, Mortgages Made Easy, is available now.

![shutterstock_78844885[1]](http://brucebrammallfinancial.com.au/wp-content/uploads/shutterstock_788448851.jpg)