Actions and consequences – every one of the former comes with one of the latter.

Actions and consequences – every one of the former comes with one of the latter.

Usually, it’s big actions that have big consequences, while we’re told “don’t sweat the small stuff”. I disagree. The small stuff, repeated daily for years, can have huge, leveraged, effects on our lives.

Like a daily, mid-morning, muffin. Whether choc-blueberry sweet or egg-and-bacon savoury, both lead down the path of “muffin tops”.

In financial speak, “actions and consequences” translate almost perfectly to “risk and reward”.

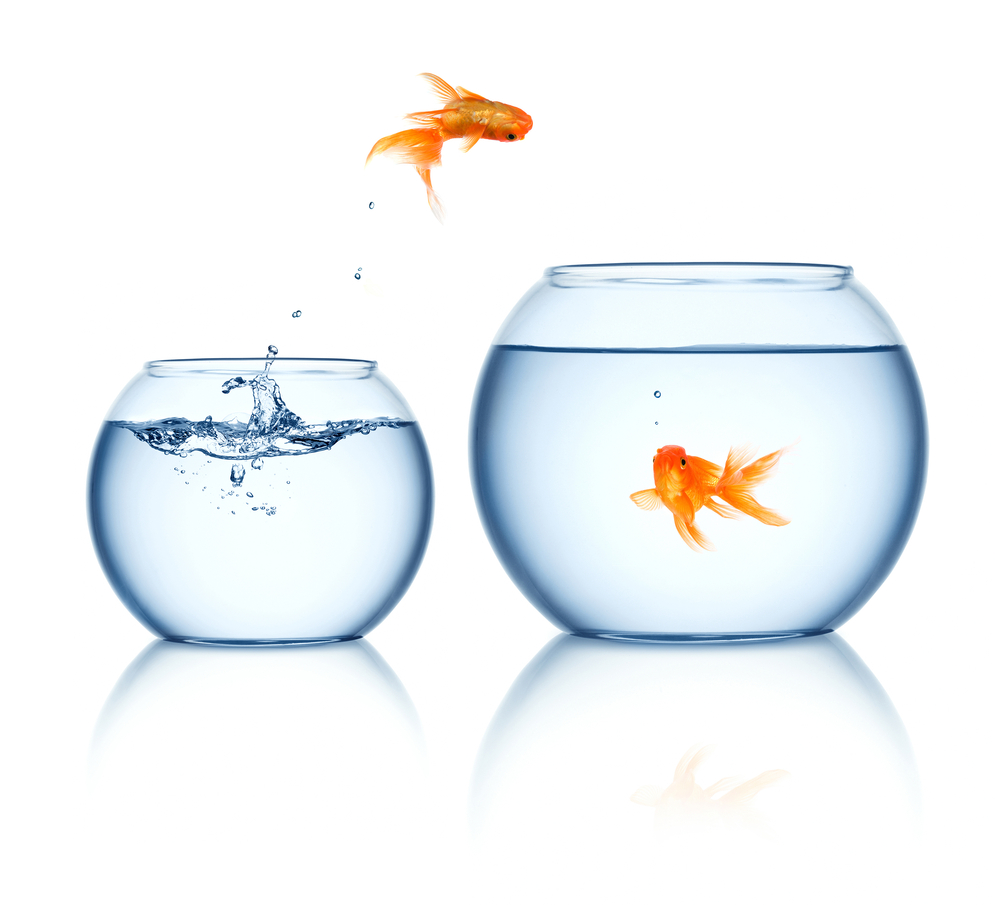

Take little action/risk, expect little consequence/reward. Take big risk, understand that the reward might also be big … or bad.

That applies to investing in super. But with a twist. With super, taking a small extra risk a day – a tiny muffin – because it is necessarily over a longer time period, the more likely it is to work in your favour.

During your working life, your focus should be on trying to create a monstrous super balance. An amount that you can take into retirement that will allow you to grow old disgracefully and embarrass your kids with your lifestyle.

“Sorry, sweetheart, I’d love to babysit the grandkids for you next month, but your father and I will be in Croatia. No, wait, Hungary. Actually, we might not have left Egypt by then.”

If you want an obscenely large super fund, there are only two ways to get there. First, you can contribute bucketloads to it. Second, you could take on some bigger risks. The truly stupendous super funds will usually be owned by people who do lots of both.

Extra contributions involve ongoing and immediate “pain”. Putting extra into super now means losing access to that money until you’re at least 60.

The second can be a less painful. If your super provider is a reasonable mob that you’re happy to stay with, it might only take 15 minutes of your time.

Do you have any clue about what your super is invested in? Have you ever even spoken to your super fund? (And if you don’t want to, see a financial adviser.)

Sadly, most Australians trundle along in blissful ignorance, occasionally grabbing their semi-annual super statements and smiling or frowning based on the headline return achieved.

Most don’t realise they have a choice in regards to the risks being taken in their super funds. But they do.

Time to call them. Ask them what percentages are in cash, bonds, property and shares. The typical “balanced” fund – where about four in five Australians are by default – will have about 60 per cent in property and shares (growth assets) and 40 per cent in cash and bonds (income assets).

The younger you are (particularly under, say, 45) the more you should have in property and shares. In your 20s and 30s, consider putting 80-100 per cent into those asset classes.

In your 40s, perhaps ease back a little.

But understand this: even when you’re 40, you will still have at least 20 years until you can begin to access your super. It’s still an ultra-long-term investment. And even at 60 or 65, it’s designed to change slightly to become an income stream, which should last you another 20 or 30 years.

That extra portion in shares and property can potentially add tens of thousands of dollars (or more) into your super fund over decades.

For all but the lucky few in defined benefit funds, you need to understand that you actually have considerable control over your super. You can control how it’s invested. You can decide the risk. And you can make changes, usually as simply as a phone call and a couple of signatures.

But we tend not to exercise that control. We dither away in default “balanced” funds.

We drum action/consequence into our kids from birth. The naughtiest stuff is generally the most fun, so long as you don’t get caught. Caught naughty actions come with parental consequences that might be unpleasant.

But as we age, we understand that some risks are calculated and, given enough time for investment markets to do their thing, are far less risky overall than they might appear.

Will you take a small action with your super fund today to allow years to compound into a potentially major consequence?

Go on, order your super fund with a muffin top.

Bruce Brammall is the principal adviser with Castellan Financial Consulting and a licensed mortgage broker (www.castellanfinancial.com.au). E: bruce@castellanfinancial.com.au.