SUMMARY: Investment returns in your SMSF cannot be viewed in isolation. They need regular review. And a dose of realism.

Australia’s single largest superannuation fund missed its target in FY16. Missed it by a bit, too.

And the collective knees of the Future Fund’s leadership are quivering.

They have a target and on a long-term basis, they are currently ahead of it. But the problem is, in a low-return environment, they’re worried that the bar has been set too high for the short and medium terms. And as with anyone who is facing a difficult target, they would like the bar lowered.

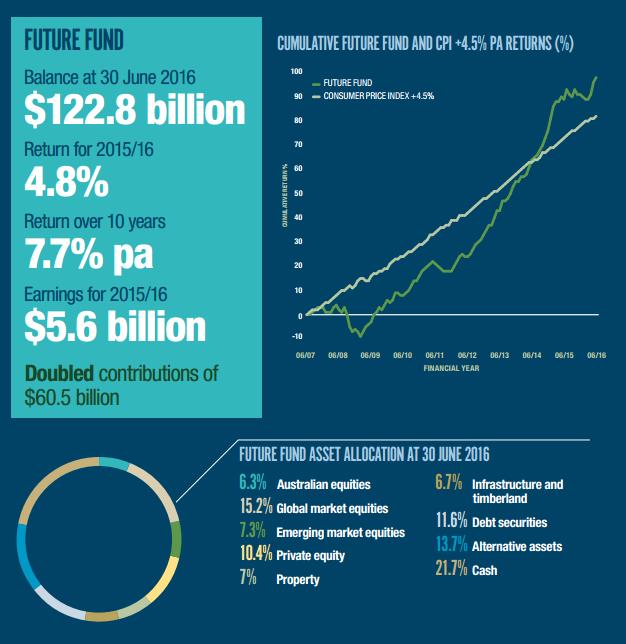

The Future Fund’s investment return target is inflation +4.5% to 5.5%. Last year, inflation was 1.3%, so their return should have been around the 5.8% to 6.8% mark. They only achieved 4.8%.

Peter Costello is the current chairman of the Future Fund. He’s also the former Federal Treasurer and the man responsible for setting up the Fund and, by virtue of nominating the parameters, setting its targets.

But he’s now pessimistic about future investment returns, based on a limited ability by governments to create stimulus.

“Today, investors face a low-return environment … this is unlikely to be a short-term phenomenon.”

The suggestion is, essentially, that trying to achieve approximately 5% above inflation – if inflation is sitting at 1.5% to 2% – is potentially too big an ask.

Now Costello is buttering up the powers that be that they might need to accept what the rest of us have been discussing for more than a year. And that is returns are likely to be lower for longer.”The board is engaging with the responsible Ministers to maintain a clear and shared understanding of these issues. This will ensure that the investment mandate properly reflects the government’s risk and return expectations, the prevailing investment environment and the longer-term ability of the Future Fund to help ease pressure on the budget,” Costello said in the annual report.

Read: “Lower your expectations and our targets. Please.”

Table 1: Future Fund statistics

Source: Future Fund 2016 annual report

This is likely to be a wider problem than just for Australia’s sovereign wealth fund. It will impact across the funds management industry, on any manager who has a target that is set based on sizeable scoring above an annual inflation rate.

But what about SMSFs? And what about their targets?

There are no rules that state that an SMSF trustee must hit a particular target. It is up to the trustee to set, or not set, a particular rate of return to be chased.

Most won’t. If they do, it should be covered in the “investment strategy”, which is a legally required document. (I am constantly surprised by the number of SMSF trustees who are operating without this document. If you want a refresher on its importance, please see this column 10/3/2010.)

An investment strategy should lay out the sorts of risks that the trustees are prepared to take in order to achieve the required retirement income streams that the members are seeking. It shows that the trustees have taken the responsibility of their duties seriously.

But my real question is “Should SMSF trustees set down their expected rate of return?”

Yes and no.

In the “no” corner, the case would be built on it setting yourself up for failure and that the target is meaningless, with no consequence (ie, unlike those running the Future Fund, you can’t be sacked) for failure.

For those SMSFs whose investments are centred on a proportion in Australian shares and the remainder in cash, the returns are going to be strongly based on a small return from cash, then biased in the direction of where the ASX 200 moved for the year.

The yes case would be built around setting achievable targets and then holding yourself/yourselves accountable to them. It should, in theory, lead to better diversification of assets, potentially away from the cash/Australian shares targets and into some international shares, property and bonds.

FYI: For instance, have a look at Table 1 again. The Future Fund has only 6.3% of its funds invested in Australian shares and nearly four times that amount invested in international shares (international and emerging markets). Though there is likely to be a percentage of Australian business assets in “private equity” and “infrastructure and timberland”.

If yes, then what are suitable targets? Some will choose an inflation base, with a out-performance kicker. Others more focussed on Australian shares, might choose something related to the ASX200 accumulation index.

If you set one, ideally it should be in the fund’s investment strategy. And it should be reviewed regularly, to make sure that it is relevant to the sorts of returns that you need/want.

For example, in your earlier years of investing via your SMSF, you are more likely to chase higher returns and accept the higher risks that come with that. As you move into your 50s, if you have achieved a reasonable investment sum, you might wish to dial back the risk and accept the lower medium term returns that follow.

Often, in retirement, and the older one gets, the idea of taking high risk is not fathomable. And more and more of the investment funds will be directed towards income-based, or lower-risk, assets, such as cash and fixed interest. In those cases, the sought-after returns need to be reduced, in line with the likely returns from those asset classes.

A good investment strategy will have these risks considered. Although there are no real rules around what needs to be in an investment strategy, the better ones will run for 5-10 pages and won’t simply be a list of asset classes with upper- and lower-end percentages next to them.

The Future Fund is managing money for the nation – specifically to pay the unfunded liabilities associated with the old government defined benefit funds. The Federal Government may begin to draw on it from 2020 to pay what isn’t funded through consolidated revenue.

Even though the Future Fund is ahead of its long-term objective (seen via the worm chart above), Costello is looking into the future to say that the inflation plus 4.5% to 5.5% is unlikely to be hit in coming years. If the board wants the investment target changed, they are going to have to do some lobbying. The heads of the board and the senior executives are on the block.

As the trustee of your SMSF, you don’t need to worry about getting the sack. But you need to be constantly vigilant about the investment decisions that you have made.

Reviewing your investment strategy, regularly (though regularly is not defined), is an important duty of a trustee. And whether or not you decide to hold yourself accountable to an investment target is therefore your decision.

You should take into account what’s happening. And potentially consider the impact of what is seen as inevitable – the expected lower returns that the investment world claims is unavoidable.

And there’s nothing wrong with setting a target. Failure will occasionally happen. But it will probably give you more of a focus. And push you to look at some options for diversification.

*****

The information contained in this column should be treated as general advice only. It has not taken anyone’s specific circumstances into account. If you are considering a strategy such as those mentioned here, you are strongly advised to consult your adviser/s, as some of the strategies used in these columns are extremely complex and require high-level technical compliance.

Bruce Brammall is managing director of Bruce Brammall Financial. E: bruce@brucebrammallfinancial.com.au . Bruce’s new book, Mortgages Made Easy, is available now.