Just another January … after another massive spending season, we get smashed on the stock market to the tune of tens of billions of dollars.

Can’t we just take a holiday, without having to watch blood red dripping from the ASX boards? Especially after we’ve hocked ourselves into next financial year with a gazillion dollars burnt into credit cards over Christmas?

Seriously, what sort of a holiday was that?

Is the Chinese government just playing with us, like a cat with a ball of wool? What other country on earth would savage all known rules of stock market regulation … in the middle of our nationally designated beer-drinking season?

I don’t care what their excuse was. I will protest by not buying an Tsing-Tao for the next month. Nah, three months. And the DebtMan family has banned yum cha for next week’s Chinese New Year celebrations also.

That’ll hit ’em where it hurts. (Or maybe not.)

So, it’s February. You will have recently receive your credit card bill for your Christmas spending sins. Some will have fainted.

And unless you’ve been out of wifi range, you should know that your portfolio hasn’t looked this sick since the summer of 2013.

Truly cruddy start to 2016. But let’s not be defeatist. How do we turn it around? How do we get this year to be profitable?Start with a hitlist. What do you want to achieve in 2016? Write it down. Then move towards it.

First: Consider your super. If you’ve considering taking more risk in super, say shifting from a balanced fund from a growth fund, then perhaps now is your chance.

Markets are down. If you’ve been taking less risk in super than you know you should, consider shifting to something with more shares and property and less cash and fixed interest.

Call you super fund and ask the questions, if you feel confident enough to make the decision on your own. If not, see a financial adviser.

Having more shares and property in your super investment portfolio could add tens of thousands to your retirement kitty, with enough time to ride out the bumps.

Second: Have you got a home mortgage?

Last year was chaotic in the mortgage industry. The rules changed almost every week.

When the dust settled, home owners were the winners. Banks were forced to put up interest rates for investors. They compensated by lowering interest rates for home-owners.

But, of course, banks aren’t doing this voluntarily. You need to fight for it. Either pluck up the courage to threaten your bank yourself, or get a mortgage broker to do the dirty work for you.

There’s little more satisfying than getting your mortgage interest rate cut. Free money. Yours to take.

Three: Take control of the credit card.

Seriously. Wealth destroying stuff. Owing money on your credit card is the definition of living beyond your means.

We owe an average of $4370 each on which interest is paid. That’s more than $60 a month in interest being paid.

More than any other debt, credit card debt is a financial killer. Get yours under control. It will probably just mean a few lean months, so you can get to the point of paying it off in full every month.

Four: Start, or add to, your investment portfolio.

Sure, China is looking like making markets turn 50 shades of ugly this year. But the commies might turn this malaise around. Or common sense might suddenly grip markets. The sky isn’t, really, falling in.

Five: Work. Make it count.

Most of us are going to be employed for about 45 years, give or take.

If you enjoy your job, make the most of it.

Upskill yourself. Accept new challenges. Take on extra training. Learn a new skill, bring something to the office that makes you indispensable.

If you’re not enjoying it, don’t moan about it. Reskill yourself. Educate yourself for an industry you will enjoy. Don’t dig yourself in to work at doing something you hate. It will make you miserable.

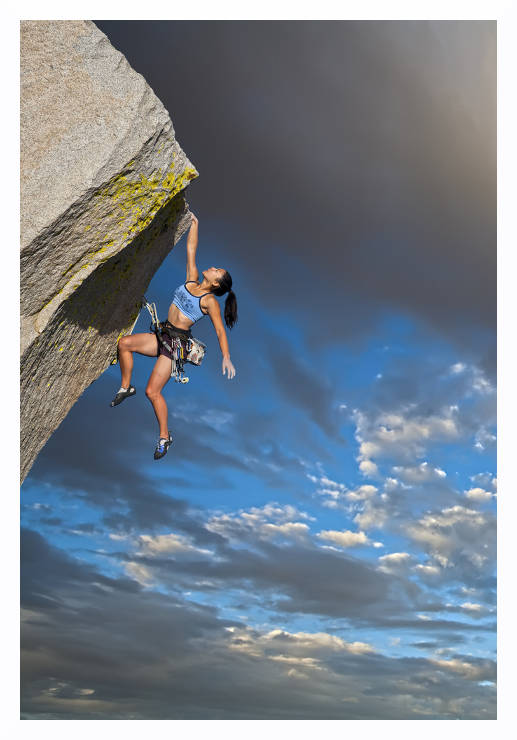

Christmas/January are usually times for monkeying around for Australians. The Chinese ruined that for us.

This year, 2016, is the Chinese zodiac year of the monkey. Let’s ignore their lead and show them we know how to turn a year around.

Bruce Brammall is the author of Mortgages Made Easy and managing director of Bruce Brammall Financial. E: bruce@brucebrammallfinancial.com.au.